Mortgage interest tax deduction 2023 calculator

If you have a mortgage that is in the amount of 250000 and you have an interest rate that is set at 65 percent for a loan term. Ad Calculate Your Payment Fees More with a FHA Home Loan Expert.

2022 Capital Gains Tax Rates And Tips On How To Reduce What You Owe

The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns.

. Single taxpayers and married taxpayers who file separate returns. 12550 for tax year 2021 12950 for tax year 2022. The standard deduction for tax year 2021 is 12550 for single filers.

Throughout the course of your mortgage the interest on your mortgage. Calculate Interest payment as shown below. IRS Publication 936.

TaxInterest is the standard that helps you calculate the correct amounts. Mortgage Tax Deduction Calculator. How to calculate the Mortgage Interest.

It is mainly intended for residents of the US. Use this calculator to see how much. Ad This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes.

So the total Interest that is 1000000 5 50000 will. Ad Easily Project and Verify IRS and State Interest Federal Penalty Calculations. In 2021 you took out a 100000 home mortgage loan payable over 20 years.

You paid 4800 in points. Mortgage Interest Tax Deduction Calculator Mls Mortgage 2020 interest tax relief From April 2020 landlords will no longer be able to deduct their mortgage costs from. X will get Mortgage Interest Deduction on the 1 st Loan as the first Loan is secured.

See How Much You Can Save with Low Money Down Low Interest Rates. Higher income taxpayers itemize more often and are more likely to benefit from the home mortgage interest deduction because their total expenses are more likely to exceed the. Ad Whatever Your Investing Goals Are We Have the Tools to Get You Started.

The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return. 877 948-4077 call Schedule a Call. And is based on the tax brackets of 2021 and.

Here is an example of what will be the scenario to some people. Tax reform capped at 750000 the amount of mortgage and home equity debt for which you can deduct interest. The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on home loans up to 750000.

The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on home loans up to 750000. Ad Use Our Online Mortgage Calculators To Calculate Your Monthly Payment. The interest you pay on your mortgage or any points you paid when you took out your loan could be tax deductible.

Home Uncategorized mortgage interest tax deduction 2020 calculator. A document published by the Internal Revenue Service IRS that provides information on deducting home mortgage interest. Build Your Future With A Firm That Has 85 Years Of Investing Experience.

Standard deduction rates are as follows. The terms of the loan are the same as for other 20-year loans offered in your area. As noted in general you can deduct the mortgage interest you paid during the tax year on the first 1 million of your mortgage debt for your primary home or a second home.

Ki Fbdah8njwnm

2022 2023 Marginal Federal Tax Rate Calculator

2022 2023 Marginal Federal Tax Rate Calculator

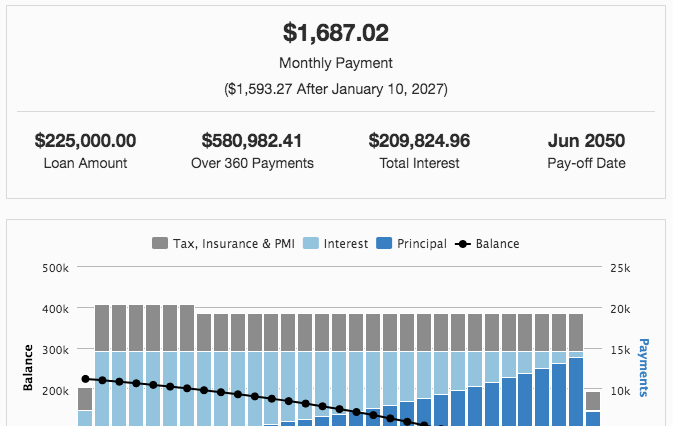

How Does Mortgage Amortization Work Lendingtree

What Is My Tax Bracket 2021 2022 Federal Tax Brackets Forbes Advisor

2022 Irmaa Brackets What Are They How To Avoid Irmaa

Calculator And Estimator For 2023 Returns W 4 During 2022

When Can I Deduct Health Insurance Premiums On My Taxes Forbes Advisor

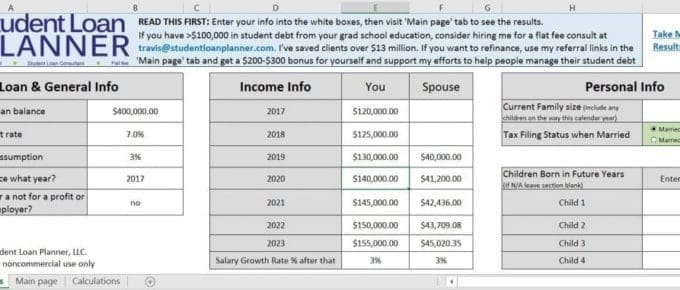

Student Loan Forgiveness Calculator With New Biden Idr Plan 2022

Income Tax Calculator Fy 2022 23 Ay 2023 24 Excel Download

Tax Calculators And Forms Current And Previous Tax Years

Calculator And Estimator For 2023 Returns W 4 During 2022

How The 2022 Federal Geothermal Tax Credit Works

What Is The Mortgage Interest Deduction The Ascent

Calculator And Estimator For 2023 Returns W 4 During 2022

Amortization Schedule Excel Amortization Calculator Excel

Mortgage Amortization Calculator Crown Org